Friday Email: 22 April 2022

Every Friday morning our lead analyst Mark Riding sends out his weekly run-down and upcoming events in the investor calendar, like this one:

The FTSE 100 is up 10 points (0.13%) on the week. The Stoxx 600 is down 0.09% and the S&P 500 is down 1.48%.

The past week has been very quiet as the UK reporting season has drawn to a close. The US market is busy as the Q1 dividends get declared.

The week ahead is slightly busier than last week.

Going ex dividend this coming Thursday with yields in excess of 2% from the single dividend we have Gulf Keystone Petroleum (9%), Bakkover (3.6%), St James's Place (3%), Tyman (2.9%), Morgan Sindall (2.6%), M.P. Evans 2.3%, Fresnillo (2.3%), Sabre Insurance (2.2% Ordinary plus 2.1% Special) and Property Franchise group for 2.1%.

The extract below is from the recent Final results of Gulf Keystone Petroleum. The yield from this dividend of 9% is very high, but it has not yet been formally declared as an amount, which is why we still have it as an estimate.

Today declaring $90 million of dividends, representing further delivery against GKP's strategic commitment of balancing investment in sustainable growth with shareholder returns:

o $25 million final 2021 ordinary dividend subject to approval at AGM on 24 June 2022

o $65 million interim dividend, expected to be paid on 13 May 2022, based on a record date of 29 April 2022 and ex-dividend date of 28 April 2022

The Company will disclose the US dollar and pounds sterling rate per share for both dividends prior to their ex-dividend dates

New into DividendMax at the request of a member we have Falanx Group.

Below follows a message from my DividendMax co-founder:

Last week I mentioned I’d be sharing some of the story of DividendMax in upcoming Friday emails.

Mark and I started DividendMax in 2011 having worked together in London.

He had been a financial analyst and me a software developer for Commerzbank (formerly Dresdner Kleinwort). So in Mark’s front room in Harpenden we built the first version of DividendMax (.co.uk back then) with just the FTSE 100.

We incrementally added more UK companies and some large European and US stocks.

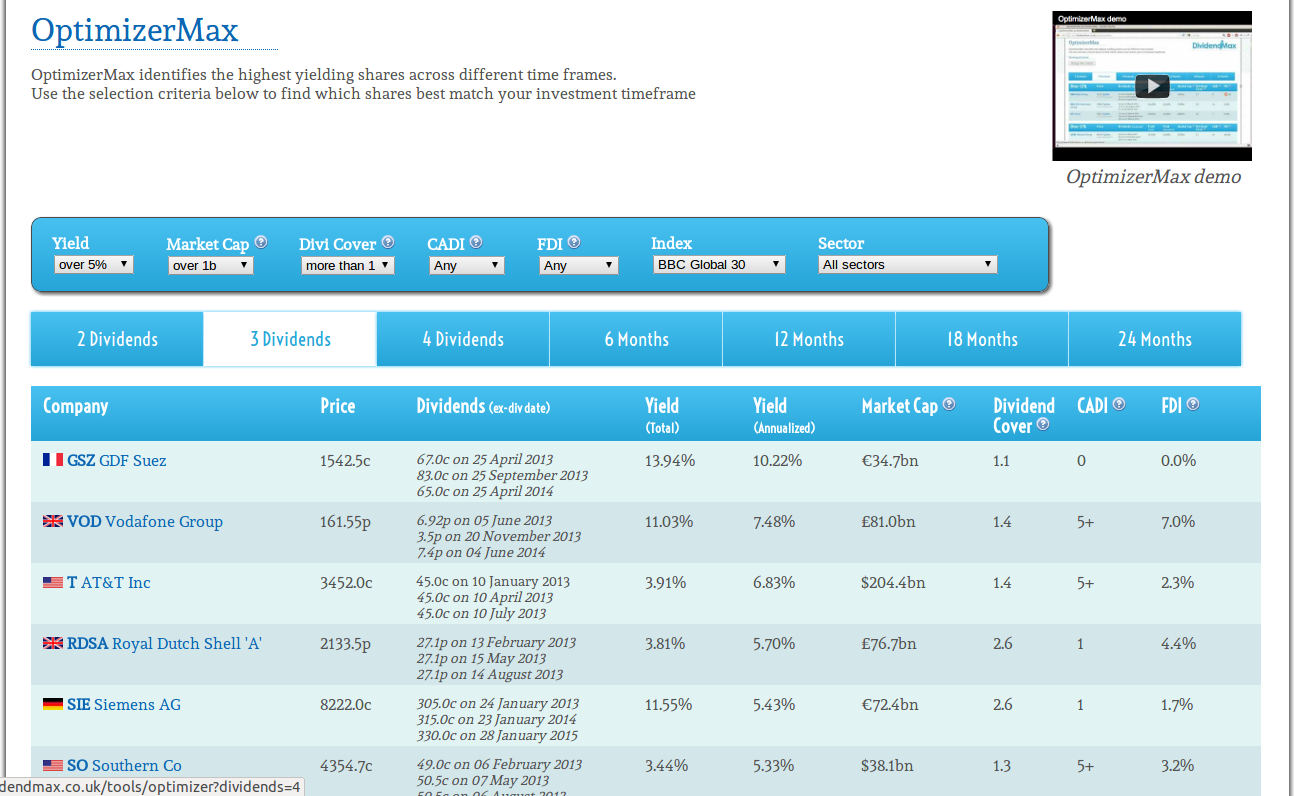

The original site was not exactly what I would call beautiful:

So much blue

But the site did receive some attention from investor friends.

On 1 November 2011 I got this message from Mark:

We have actually got a subscriber who is not part of the beta test!

To which I responded:

Don't get too excited, that's a guy I know :-)

And so DividendMax was inauspiciously launched…

Then on 20 January 2012 08:26, Mark wrote:

We got a paying subscriber this morning!!!!!!!

And it was our first legitimate paid subscription, and from then we started believing this thing could work and that people saw enough value to take up a paid subscription.

We worked hard with putting content on the site we thought our users would find useful and this has the added benefit of boosting our performance in Google.

We have been fortunate that Google favours DividendMax.com when you search for dividend information for particular companies, particularly in the UK.

In July 2017 we launched the dividend notification service which sends emails to you when a company you follow declares a dividend. This also proved a very popular service (in February we sent 144,000 dividend notification emails - 66% were opened).

These factors mean we now get more than 250k uniques to the site every month, and every day we have new paying members.

I’ll share more next week, for now I will leave you with this Trustpilot review from one of our earliest members:

Used this site for about 10 years.

Very good source of dividend information. Dividend forecasts are usually very accurate. Site has improved regularly over the last ten years, the last update a vast improvement with easily available information

Thanks for your support!

Jonno

If you were forwarded this email and want to subscribe yourself, please click here to subscribe

The Friday email is delivered to over 20,000 subscriber’s every week, and remains a widely read run-down of recent events and what investors can expect in the week ahead written by our chief analyst Mark Riding.

It’s included as part of the free DividendMax trial.